sales tax calculator reno nv

Find list price and tax percentage. How to Calculate Sales Tax.

Nevada Sales Tax Small Business Guide Truic

The reno nevada general sales tax rate is 46.

. Divide tax percentage by 100 to get tax rate as a decimal. Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates. Get a quick rate range.

Click any locality for a full breakdown of local property taxes or visit our Nevada sales tax calculator to lookup local rates by zip code. Nevada state sales tax rate range. RE trans fee on median home over 13 yrs.

Every 2020 q4 combined rates mentioned above are the results of nevada state rate 46 the county rate 3665. Nevada sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The base state sales tax rate in Nevada is 46.

Sales Tax State Local Sales Tax on Food. The minimum combined 2022 sales tax rate for Reno Nevada is. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Find your Nevada combined state and local tax rate. Nevada NV Sales Tax Rates by City R The state sales tax rate in Nevada is 6850. 3 beds 2 baths 2364 sq.

Spacious floor plan. Local rate range 0-3665. Nevada largely earns money from its sales tax which can be one of the highest in the nation and varies from 685 to 8375.

Exact tax amount may vary for different items. 2022 Cost of Living Calculator for Taxes. The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation.

Real property tax on median home. Then use this number in the multiplication process. Calculating how much sales tax you should remit to the state of Nevada is easy with TaxJars Nevada sales tax report.

Low property taxes and the absence of any state or local income taxes in Nevada can make it a particularly affordable place to own a home. Rachel nv sales tax rate. With local taxes the total sales tax rate is between 6850 and 8375.

There are a total of 34 local tax jurisdictions across the state collecting an average local tax of 3357. The County sales tax rate is. 2291 Lousetown Rd Reno NV 89521 672000 MLS 220006658 Amazing Ranchette sitting on 142 acres nicely tucked away from road.

Total rate range 46-8265. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable. Select the Nevada city from the list of cities starting with R below to see its current sales tax rate.

Our Premium Calculator Includes. Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nevada local counties cities and special taxation districts. Local sales tax rates can raise the sales tax up to 8375. All you do is connect the channels through which you sell including Amazon eBay Shopify Square and more and well calculate exactly how much sales tax you collected.

For tax rates in other cities see Nevada sales taxes by city and county. The state sales tax rate in Nevada is 46 but you can customize this table as needed to reflect your applicable local sales tax rate. Nevada has recent rate changes Sat Feb 01 2020.

Base state sales tax rate 46. The correct tax rates will display based on the period end date selected. Nevada Sales Tax Nevadas statewide sales tax rate of 685 is seventh-highest in the US.

There is no applicable city tax or special tax. Cost of Living Indexes. You can print a 8265 sales tax table here.

Taxes in Reno Nevada are 89 cheaper than Minden Nevada. 2022 Cost of Living Calculator for TaxesReno Nevada and Las Vegas Nevada. The Nevada sales tax rate is currently.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. The Reno sales tax rate is. Reno Nevada and Las Vegas Nevada.

The table below shows the county and city rates for every county and the largest cities in the state. NV Sales Tax Rate. 2022 Nevada state sales tax.

In the 2011 Legislative Session reduced the interest rate to 075 or 0075 from 1 or 01 effective 712011. All the information you need to file your Nevada sales tax return will be waiting for. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375.

The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax. Average Sales Tax With Local. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes.

The current total local sales tax rate in Reno NV is 8265. If you need access to a database of all Nevada local sales tax rates visit the sales tax data page. This is the total of state county and city sales tax rates.

The combined rate used in this calculator 46 is the result of the nevada state rate 46. Therefore a home which has a replacement value of 100000 will have an assessed value of 35000 100000 x 35 and the home owner will pay approximately 1281 in property taxes 35000 x 3660615. The December 2020 total local sales tax rate was also 8265.

Nevada has state sales tax of 46 and allows local governments to collect a local option sales tax of up to 355. Multiply the price of your item or service by the tax rate. Groceries and prescription drugs are exempt from the Nevada sales tax.

Sales Tax By State Should You Charge Sales Tax On Digital Products Taxjar

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings

City Of Reno Property Tax City Of Reno

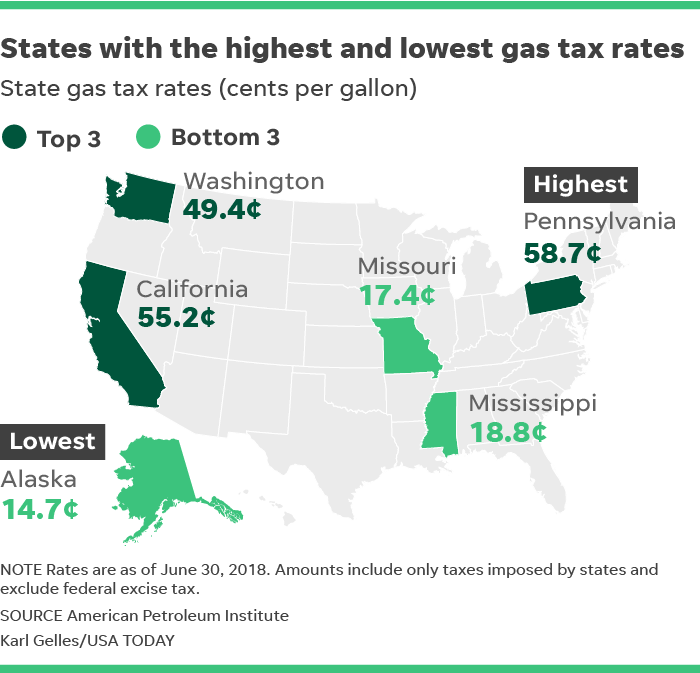

Sales Taxes In The United States Wikiwand

How To Calculate Cannabis Taxes At Your Dispensary

Sales Taxes In The United States Wikiwand

Nevada Income Tax Nv State Tax Calculator Community Tax

2020 Nevada Sales Tax Form Sema Data Co Op

Sales Tax In Las Vegas Nv Sema Data Co Op

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

Sales Taxes In The United States Wikiwand

Ifta Calculator Tax Software Cool Photos Tax

Nevada Income Tax Nv State Tax Calculator Community Tax

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

Nevada Income Tax Nv State Tax Calculator Community Tax

How To Calculate Cannabis Taxes At Your Dispensary

Oklahoma Sales Tax Calculator Reverse Sales Dremployee